2021 Precision Agriculture Dealership Survey Confirms A Data Driven Market For Retailers

2021’s Precision Agriculture Dealership Survey shows that retailers more and more are making crop management decisions guided from insights originating from their growers’ fields. Pooled, on-farm data, especially for nutrient management, hybrid/variety selection and planting rates, are guiding decisions at rates twice that of just four years ago. The optimism from previous surveys continues for UAVs and for variable pesticide applications, and UAV’s role in applying crop inputs. And compared to two years ago, substantially fewer dealers say customer-related and dealer-related factors are holding back their progress on implementing more precision ag.

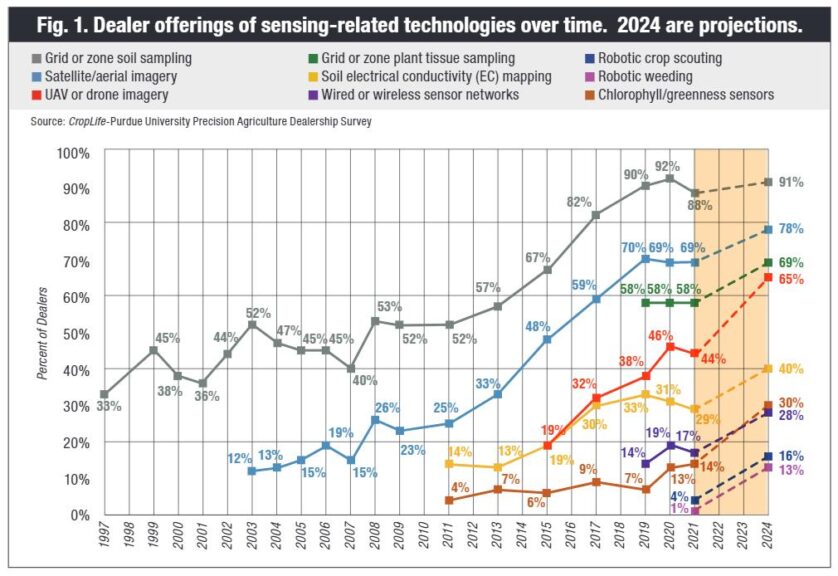

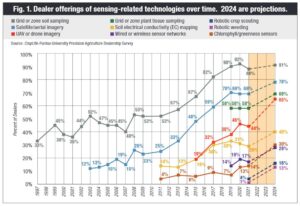

Precision agriculture is a management strategy, but its practical implementation depends on a variety of mostly digital tools to capitalize on its benefits, from sensing, to analysis, prescriptions, and on to applications. These tools evolve and change over time, which drives the interest for the survey results. Some tools have proven their place with most retailers, such as grid or zone soil sampling — although that journey took over two decades (Figure 1). Most dealers offer satellite or aerial imagery, and more say they will be adding this in the future. Imagery can be a foundation for creating management zones or guiding site-specific inputs. But still being vetted are robotic weeding and robotic scouting, and applying crop inputs via drone. Only a few dealers responded that they were currently offering services in robotic weeding or robotic scouting.

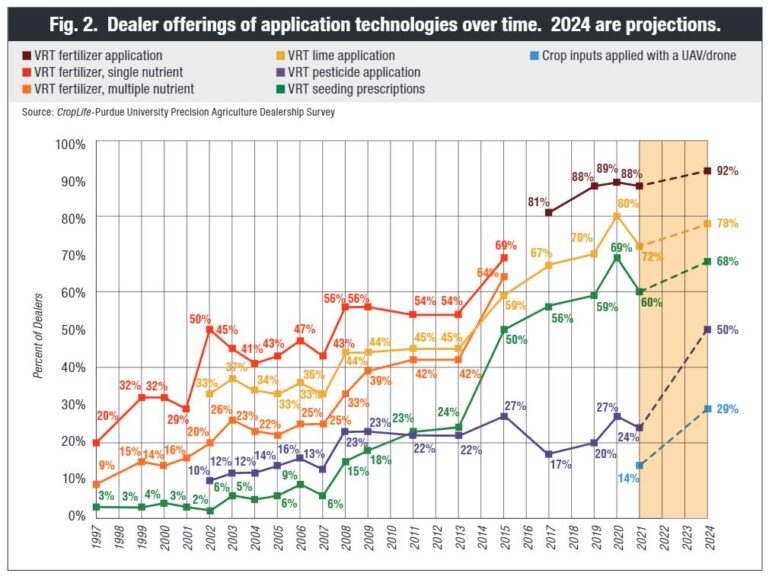

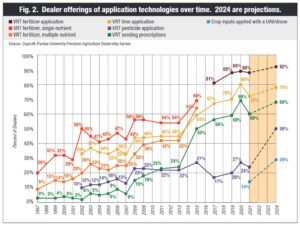

Thirteen percent of respondents indicated they would be offering robotic weeding and 16% would offer robotic scouting in three years, showing great confidence in their potential. Fourteen percent of dealers say they are currently offering crop inputs applied via a UAV/drone, but 29% expect to be offering this by 2024 (Figure 2). The data represent the percent of dealers offering these services, not the percent of acres where these services were applied.

The major categories of information collected in the survey include what products and services dealers are offering, their profitability, what technologies the dealers are using in their retail operations, such as for scouting or custom application, and what factors are affecting their businesses. Variable-rate technology (VRT) services, where a data-driven approach is used to address inconsistency across fields, dipped slightly in 2021, but most types remain far above the levels of a decade prior (Figure 2). From 2002-13 about half of dealers were offering VRT fertilizer applications, but the mid-2010s were a pivot point, increasing to 69% in 2015 and now just short of 90% of dealers. VRT seeding recommendations have made a huge jump in the last several years, from 24% in 2013 to 50% in 2015, and 60% of dealers now offering these services.

Only one quarter of dealers indicate they now offer variable rate pesticide applications, a number that has bounced around but still similar to a decade prior. Some year-to-year variation of survey results is normal, as survey respondents differ each year. But similar to 2019 and 2020 half of the dealers foresee they will be offering this in the near future. The other big increase expected is for dealers adding UAV/drone imagery services. There have been tremendous investments in both of these technology areas in the last decade — for instance machine vision and recognition technology for weeds, and the ease with which drones can be flown and images georeferenced and stitched compared to just a few years ago.

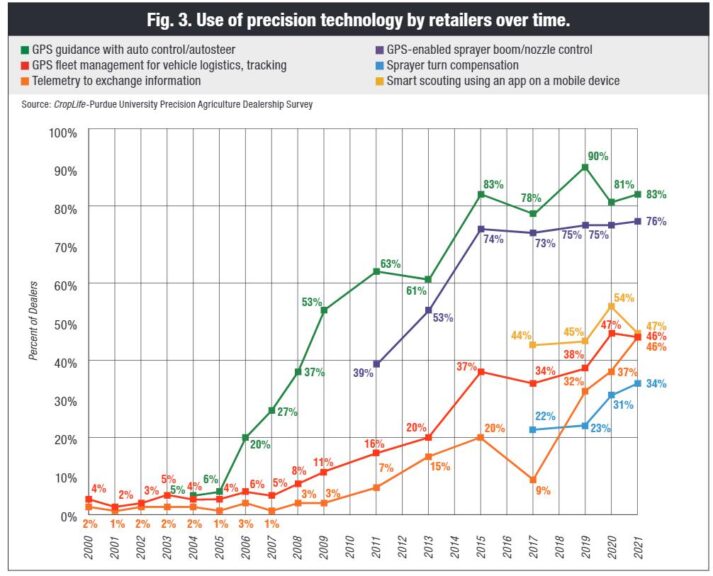

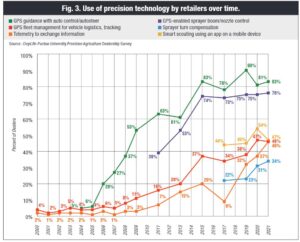

The use of guidance technologies by dealers for their custom pesticide and fertilizer applications indicate a maturing market, with 83% of dealers using autoguidance, and 86% of those who offer precision services using guidance of any type (including manual guidance/light bars). GPS-guided boom section/nozzle controllers on sprayers, which reduce doubling-up and skips, are used at three-fourths of dealerships (Figure 3). Another guidance-related technology, sprayer turn compensation, continues to grow, now at 34%. About half of dealers are using telemetry to exchange information among applicators or to/from office locations, around half are using GPS fleet management to track the locations of vehicles and guide vehicles to work sites, and about half are using some type of a smart scouting app on a mobile device.

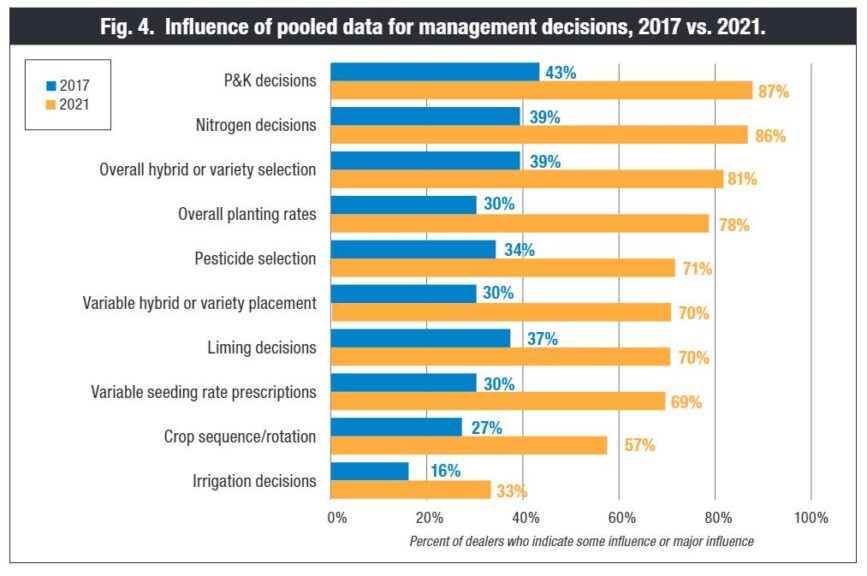

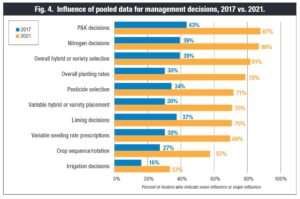

There has been a remarkable uptick in crop management decisions from pooled data in recent years (Figure 4). We define pooled data as that which is aggregated from multiple farms, either managed within the dealership or as part of an outside offering. Eighty-seven percent of dealers said phosphorus and potassium decisions were at least somewhat influenced by pooled data, similar to last year but doubling compared to four years ago, and 86% saying nitrogen decisions were being influenced, up from 39% in 2017. Eighty-one percent of dealers indicated pooled data had at least some influence for overall hybrid/variety placement, and 69% said pooled data informed variable planting rate prescriptions, both more than double compared to four years ago.

Some survey questions are asked every two years, to keep the survey length reasonable. This year we did not ask about the profitability of specific precision products and services. But we did ask dealers to rate the primary barriers preventing more farmers from adopting or expanding their use of precision agriculture, and factors preventing them from offering more precision ag services. Responses to all 18 possible barriers of adopting precision agriculture all went down in 2021 compared to 2019, with just one exception, indicating continued optimism for precision ag (data not shown). The exception was customer concerns with data privacy, which went from 11% of dealers agreeing or strongly agreeing in 2017 to 30% in 2021. Related to this is that in 2019 less than half of dealers (47%) indicated their company had a customer data privacy statement and/or a data terms and conditions agreement, but that increased to 58% last year and 59% this year. The biggest decrease in barriers was seen in “my farmers are interested in precision services, but pressure on farm income in my area limits their use,” going from 78% agreeing or strongly agreeing in 2019 to 37% in 2021. The 78% saying in 2019 that farm income pressure was a barrier was the highest of any factor in the last decade of the survey, but farm incomes have increased substantially since.

The three biggest barriers for success that dealers identified at present are “it is difficult to find employees who can deliver precision agricultural services” at 49%, “the equipment needed to provide precision services changes quickly, increasing my costs” at 46%, and “the fees we can charge for precision services are not high enough to make precision services profitable” at 42%. Excluding the farm income response, which rises and falls with commodity prices, and in 2011 when “the cost of the equipment required to provide precision services limits our precision offerings” was higher than the difficulty of finding employees, these three highest factors for 2021 were always the highest three going back a decade.