CropLife 100 Mid-Year Report: Gauging the ‘Hits’ and ‘Misses’ So Far in 2024 for Ag Retailers

Each year without fail, the growing season brings its share of trends that “hit” with grower-customers and those that “miss the mark.” In 2024, CropLife® magazine is building upon this phenomenon to chronicle the findings of our 8th annual CropLife 100 Mid-Year Survey.

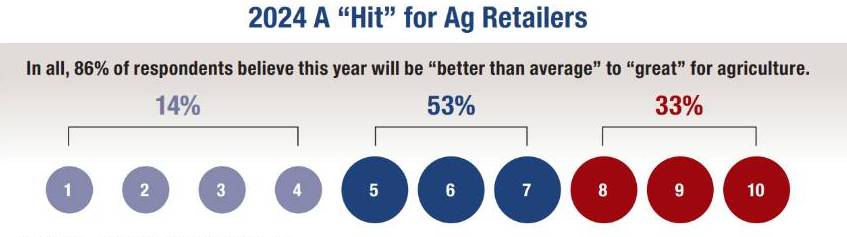

As we have done each year since the inception of this survey, CropLife started out by asking the nation’s top ag retailers their overall outlook on the 2024 growing season based upon the market performance through the spring field work/planting time. This was accomplished by asking respondents to rate the year so far on a scale of one to 10 – with one being “worse than expected” and 10 being “better than expected.” And overall, the market is pleased with 2024. A little more than eight out of 10 (86%) survey respondents rated the year so far between a five and a 10.

Source: 2024 CropLife 100 Mid-Year Survey

Broken down a bit further, 53% of the nation’s top ag retailers said the 2024 growing season rates between a five and seven on their 10-point scale. Another 33% indicated the year so far rates as an eight to 10 in their regions of the country. Compared with the findings from the 2023 CropLife 100 Mid-Year Survey, this represented a 6% increase from the 80% of respondents that said last year rated between a five and 10. Perhaps more significantly, only 14% of respondents are rating the 2024 growing season between a one and a four.

Finding Workers Gets a Bit Easier

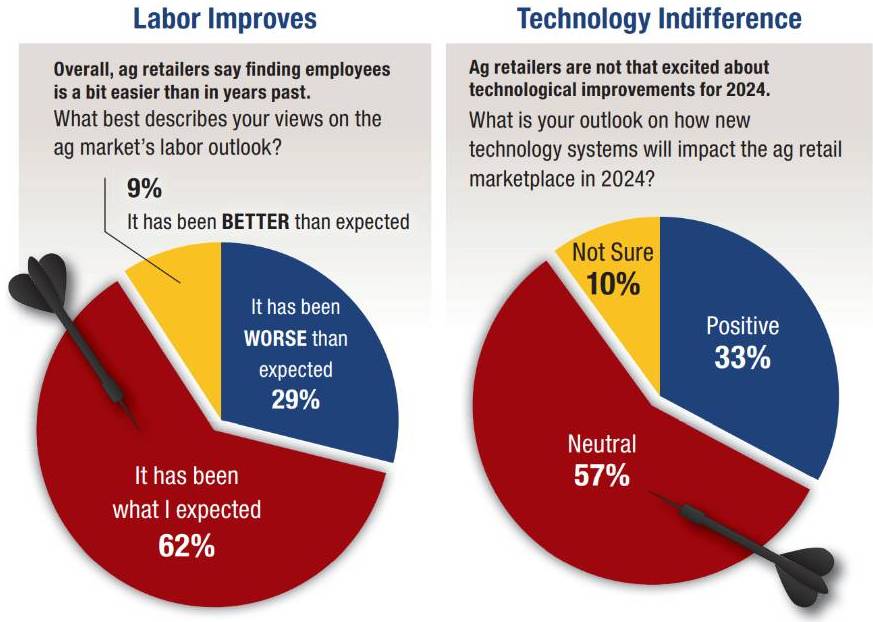

For almost as many years as the CropLife 100 rankings have existed, finding/keeping labor has been the No. 1 issue most ag retailers have faced year in and year out. In fact, according to the 2023 CropLife 100 survey, 34% of respondents rated finding/keeping a workforce as their No. 1 issue of concern during the 2023 calendar year. But it seems that this situation has changed somewhat in 2024, at least marginally.

When asked to describe the current ag market’s labor, a majority of respondents — 62% — said the situation is “about what we expected” for the 2024 growing season. But perhaps significantly, 29% of respondents said their labor issues were “much worse than expected” thus far for the 2024 growing season. This represented a significant downturn compared with the 2023 CropLife 100 Mid-Year Survey results, when 40% of respondents reported that this was their workers search situation. Even better, 9% of ag retailers said that finding workers to man their operations was “better than we expected” so far this year. This represented a 2% improvement from the 7% in the 2023 survey that said finding/keeping workers was easier than they had anticipated.

Source: 2024 CropLife 100 Mid-Year Survey

Besides labor, one other incredibly “hot” topic during the 2023 growing season was the rapid advancements being made in the area of ag technology. For the middle of the year onward, many equipment manufacturers invested heavily in bringing new technologies such as semi-autonomous vehicles and artificial intelligence (AI)-based systems to the marketplace. In addition, changes made by the Federal Aviation Administration apparently convinced numerous ag retailers to invest in agricultural drones for custom application work.

Despite all these advances in the ag technology area, many of the nation’s top ag retailers remain less than enthusiastic about these products. To gauge how the nation’s top ag retailers feel about the prospects these technology systems might offer in the way of innovation and worker assistance, the 2024 CropLife 100 Mid-Year Survey asked what kind of impact these new offerings will have on their company operations during the 2024 growing season. Overall, 57% of respondents remained “neutral” in their views on this technology. Only 33% believed such technology systems would have a “positive impact” on their operations this year. The remaining 10% weren’t sure just yet what the potential benefits technological advances in agriculture could bring to their companies.

As far as what types of ag technologies the nation’s top ag retailers plan to invest in during the 2024 growing season, there was one clear winner. Overall, 67% of respondents indicated their companies planned to purchase AI-based systems this year. The remaining 33% planned to make drones their ag technology of choice in 2024.

Fertilizer, Crop Protection Look Like “Hits”

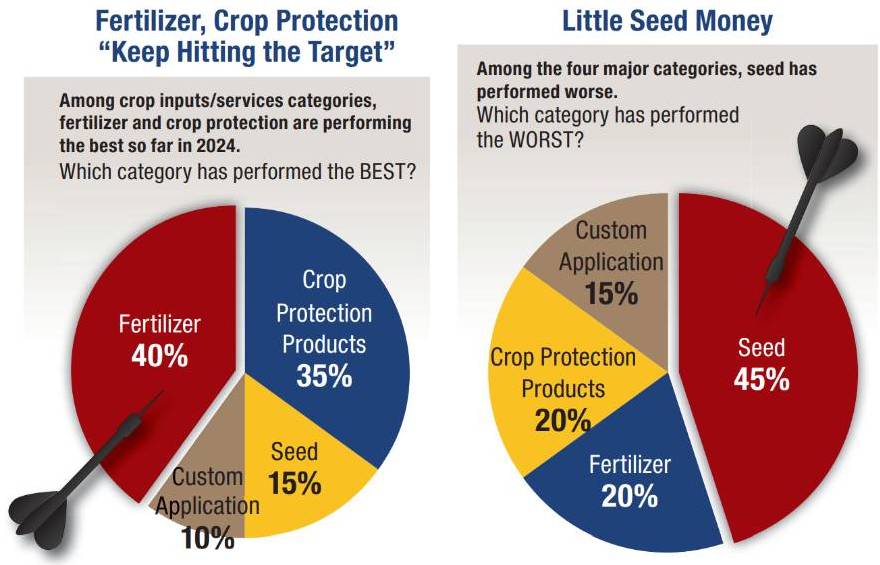

Each year since its inception, the annual CropLife 100 Mid-Year Survey has tried to gauge which of the four key crop inputs/services categories — fertilizer, crop protection products, seed, and custom application — have performed in the early going of a particular growing season. So far, there are two crop inputs “hitting their marks” for the 2024 growing season. And one can be classified as a “miss” so far.

According to the majority of 2024 CropLife 100 Mid-Year Survey respondents, two categories are leading the way in positive performance thus far this year. Based upon the survey results, 40% of respondents say fertilizer has been the category that has “performed the best” for them during the 2024 growing season. Likewise, the crop protection products category was also cited by 35% of survey respondents as their “best performer” for the year.

Source: 2024 CropLife 100 Mid-Year Survey

The other two categories — seed and custom application — are having a tougher time hitting the bulls-eye. For seed, 15% of respondents say their sales in this segment are “better than expected” thus far. In custom application, 10% of the nation’s top ag retailers are sales have been positive.

Source: 2024 CropLife 100 Mid-Year Survey

As far as which of the four major categories have performed “worse than expected” so far during 2024, one category was clearly not “hitting its mark.” According to 45% of respondents, seed sales were performing “worse than expected.” The remaining three categories split almost evenly, with 15% of respondents saying custom application sales were “worse than expected” in 2024 and 20% apiece describing their fertilizer and crop protection sales in the same manner.

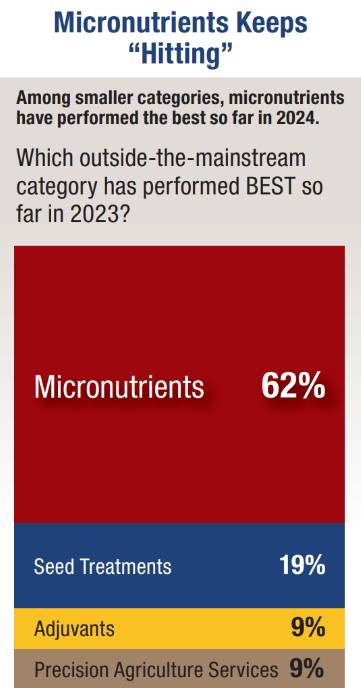

In addition to tracking the performances of the four major categories, the annual CropLife 100 Mid-Year Survey also looks at how some of the smaller segments have performed during the early going of the year. In most years, the micronutrients category tends to the one that “hits the target” consistently by respondents.

And this remains the case in 2024. According to the survey, 62% of respondents said that the micronutrients category has performed best for them this growing season. This is up significantly from the 2023 survey, when 50% of respondents said micronutrients were their best smaller category performer.

In second place among the smaller categories in performance in 2024 is the seed treatment category, mentioned by 19% of survey respondents as their “top performer.” Rounding out the “top smaller category performers” for the nation’s top ag retailers in 2024 are precision agriculture services and adjuvants, both garnering 9% apiece among respondents.

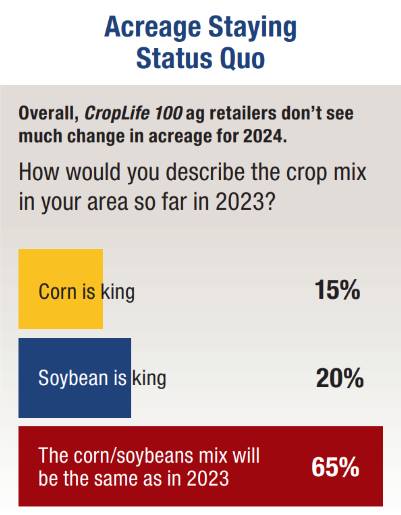

No Acreage Changes

As far as the expected crop mix for the 2024 growing season is concerned, the nation’s top ag retailers seem to see significant disagreement with the overall outlook for the entire country. At the end of March, the USDA published its annual planting intentions survey results. For 2024, the agency predicted that corn planted areas for the year would decrease 5%, down to 90 million acres. On the flipside, USDA expected soybean planted acres for 2024 to improve slightly, up 3% to 86.5 million acres.

Source: 2024 CropLife 100 Mid-Year Survey

However, according to the 2024 CropLife 100 Mid-Year Survey, the nation’s top ag retailers aren’t seeing this kind of acreage shift taking place in their areas. In fact, according to 65% of respondents, their grower-customers are expected to maintain their corn-to-soybean acreage ratios are the same level they had “during the 2023 growing season,” when corn slightly outpaced soybeans. Twenty percent of respondents did agree that, with increased demand for renewable diesel and higher commodity prices, soybeans would be “king” among their grower-customers in 2024. The remaining 15% expect “corn to remain king” in their areas of the country this year.

Looking a little further ahead to 2025, the nation’s ag retailers are currently split on if the year will be a “hit” or a “miss.” When asked to describe their outlook for the 2025 growing season, 33% of respondents were “somewhat positive” for the prospects for next year. However, 29% described themselves as “somewhat negative” in their early read for 2025. Twenty-four percent were neutral. Another 9% were “very positive” that 2025 would “hit the mark.” The remaining 5% believed it was too early to read how 2025 would play out (saying that they were “not sure”).