CropLife 100 Report: 2022 Sales for Top Ag Retailers Offer an Impressive Wow Factor

Each year for the past 39, CropLife® magazine has dedicated its December issue to reporting on the performance of the nation’s top ag retailers during the year just ending. For the 2022 report, there is only one word that best describes the state of business for this year’s CropLife 100 companies: WOW!

If you ask most people who do business in the agricultural industry about the past year or so, they will likely point out all the unusual circumstances that have plagued everyone’s business. This would include severe (and long-lasting) supply chain disruptions, transportation concerns, labor shortages, and lingering aftereffects from the two-plus years of the COVID-19 pandemic. On the surface, conventional wisdom would be that all these uncertainties in the mix would severe dampen the financial performance of many of the nation’s top ag retailers during 2022.

But this was far from the case. In fact, based upon the numbers, the exact opposite was true.

According to the 39th annual CropLife 100 survey, the nation’s 100 largest ag retailers recorded sales revenue of just shy of $46 billion during 2022. Not only was this easily the largest sales amount ever recorded for CropLife 100 ag retailers, but it represented a phenomenal 30% increase from the industry’s 2021 figure of $35.4 billion.

Let that sink in for a moment. Between 2021 and 2022, the nation’s top ag retailers increased their overall revenues $10.6 billion. During the prior 38 years of CropLife 100 surveys, the industry has normally averaged year-over-year sales gains in the $1 billion range; perhaps $2 billion in exceptional strong sales years (such as between 2011 and 2012). But in 2022, this sales figure grew by 10 times this amount year-over-year!

To appreciate just how widespread this sales boom was for ag retailers during 2022, consider the performance of the individual companies that comprise the current CropLife 100. In the 2021 survey, when companies were reporting how yearly sales, just over half (57) indicated that their revenues had increased from the 2020 growing season. Seventeen reported sales declines year-over-year during this same period, with the remaining 26 seeing no appreciable difference between their 2020 and 2021 sales.

In 2022, this definitely wasn’t the case. According to data from this year’s CropLife 100 survey, 79 companies within the CropLife 100 had sales volumes higher in 2022 than they did during 2021. Twenty ag retailers saw flat sales year-over-year. Only one company reported lower sales revenues in 2022 vs. 2021.

One, out of 100. In a word, WOW!

Fertilizer was the Key

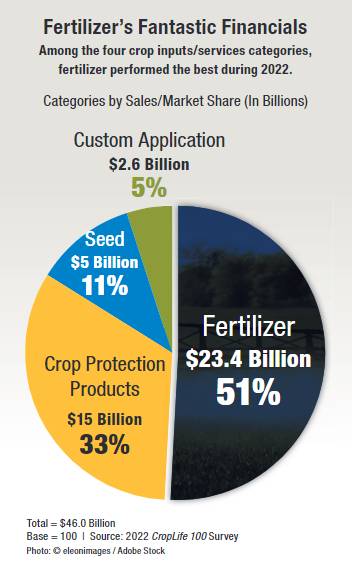

In any CropLife 100 report, the key to understanding the sales performance of the member companies ties directly back to how well (or not) the four main crop inputs/services categories did. To completely appreciate how this dynamic played out during 2022, you need only look at how the fertilizer category performed — or more accurately, outperformed.

In any CropLife 100 report, the key to understanding the sales performance of the member companies ties directly back to how well (or not) the four main crop inputs/services categories did. To completely appreciate how this dynamic played out during 2022, you need only look at how the fertilizer category performed — or more accurately, outperformed.

According to respondents of the 2022 CropLife 100 survey, total fertilizer category revenues topped a record $23.4 billion during the year. This marked an unbelievable 53% increase from the 2021 category sales total of $15.3 billion. With this sales gain, the fertilizer category improved its overall market share of all crop inputs/services within the CropLife 100 to 51%, up from 43% in 2021 and the highest market share the category has enjoyed since 2008 — the year before the infamous fertilizer market crash of 2009! In fact, the fertilizer category’s sales performance in 2022 was so strong that every other category dropped some market share because of it — despite the fact that no other category actually saw a sales decline for 2022.

Looking just at the large numbers put up by the fertilizer category doesn’t tell the entire story, however. As many market observers are sure to point out, much of the talk during 2022 centered around the fact that crop nutrients prices from suppliers were double (or sometimes triple) what they were during 2021 as supply chain disruptions and global conflicts such as the Russia-Ukraine war messed with the availability of many macronutrients throughout the entire 2022 growing season. By extension, this meant ag retailers were paying out more money to purchase various fertilizers before being able to turn around and sell them to their grower-customers. Surely, they will say, this explains the huge revenue increases for the fertilizer category.

However, if this was the only explanation for the rapid growth of the fertilizer category among CropLife 100 ag retailers during 2022, an observer might also assume that profitability took a serious hit during the 2022 growing season.

However, if this was the only explanation for the rapid growth of the fertilizer category among CropLife 100 ag retailers during 2022, an observer might also assume that profitability took a serious hit during the 2022 growing season.

But this doesn’t seem to be what actually happened. According to the 2021 CropLife 100 survey, 70% of respondents said that their profitability between 2020 and 2021 has increased between 1% and more than 5%. Seventeen percent said that their profit levels between the two years was identical. The remaining 14% reported making less money between 2020 and 2021.

According to the 2022 CropLife 100 survey, the percentage of ag retailers making more money between 2021 and 2022 actually increased. This year, 77% of respondents said that their profitability level went up between 1% and more than 5%. Another 15% said that their profit level was the same as in 2021. Only 8% reported seeing a profit level decline between the two years.

As stated earlier in this report, the other three crop inputs/services categories all had relatively positive revenue years during 2022. Although none of them outperformed the fertilizer category in terms of growth, two of the three did record sales increases for the year.

For the crop protection products category, 2022 was a decent year. According to the survey results, revenues for this category grew 16% for the year, up from $12.9 billion in 2021 to $15 billion. All three segments that make up this category — herbicides, insecticides, and fungicides — performed well, according to survey respondents, with average sales growing between 3% and 5% for 2022.

However, despite this fact, the one down note for the crop protection products category came in the market share department. Because the category failed to keep pace with the overall industry growth, the crop protection product category now holds a 33% market share vs. the other categories — a decline of 4% from the 2021 figure of 37%.

Like the crop protection products category, the custom application category was on similar growth curve for 2022. According to the CropLife 100 survey, revenues for this category improved 18% during the year, growing from $2.2 billion in 2021 to $2.6 billion. Market share, however, did fall slightly — down from 6% in 2021 to 5% for 2022.

If there was one category that underperformed during 2022, it was seed. According to the 2022 CropLife 100 survey, seed category sales were relatively flat, coming at just under $5 billion — almost identical to the figures recorded in the 2021 survey. Consequently, the market share for the seed category fell by 3% for the year, down from 14% in 2021 to 11% this year.

Hard Labor/Supply/Water

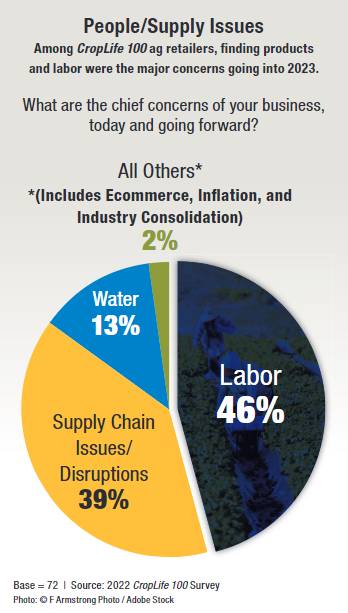

As in any year, there are always those key market issues that keep most ag retailers up at night with worry. In 2022, there were three main ones.

As in any year, there are always those key market issues that keep most ag retailers up at night with worry. In 2022, there were three main ones.

For most ag retailers surveyed in 2022, labor was once again the chief challenge. According to 46% of respondents, finding/retaining/paying top employee talent was the No. 1 issue. This was up significantly from the results of the 2021 CropLife 100 survey, when only 30% of respondents said labor was their No. 1 concern going into the new year.

Last year’s No. 1 market challenge, supply chain issues, dropped back into second place in 2022. According to this year’s survey, getting/finding products for their customers was the No. 1 concern among 39% of respondents. Still, this represented a significant drop from the 60% of respondents on the 2021 CropLife 100 survey that cited this issue as their No. 1 concern for the upcoming growing season.

The final major issue for ag retailers in 2022 seems to be more geographic specific. According to 13% of 2022 CropLife 100 ag retailers, water availability/regulations are their No. 1 concern. And this seems to be situation for any ag retailer based in the Western U.S. — particularly in the states of Arizona and California.

As for other major concerns among the nation’s top ag retailers, the remaining 2% mentioned such items as market consolidation, ecommerce, and inflation as their primary challenges to continued profitability.