Retail Remedies: Today’s Market Dynamics Favor More In-Plant Systems for Ag Retailers

Editor’s note: This article is part of CropLife’s new series called Retail Remedies. In Retail Remedies content, we offer solutions and strategies for ag retailers to present to their grower-customers to make dealing with all the uncertainty of the 2022 planting season more manageable. This will include stories on product segments — like the in-plant systems feature below — that can help growers stretch their hard-earned dollars in this time of higher crop input costs.

Editor’s note: This article is part of CropLife’s new series called Retail Remedies. In Retail Remedies content, we offer solutions and strategies for ag retailers to present to their grower-customers to make dealing with all the uncertainty of the 2022 planting season more manageable. This will include stories on product segments — like the in-plant systems feature below — that can help growers stretch their hard-earned dollars in this time of higher crop input costs.

The in-plan environment for ag retailers has changed significantly over the past few years. Starting with the appearance of the coronavirus in late 2019 and the fundamental shifts in overall market dynamics throughout 2020 and 2021, many ag retailers have seen long-term problems that have dogged their businesses become all that much worse.

For example, take labor. According to most ag retailers, finding/keeping good employees/labor has been a consistent problem for at least the past 20 years or so. In fact, in the 2021 CropLife 100 survey of the nation’s top ag retailers, 30% of respondents listed finding qualified workers as their chief concern for the company they represented and its future success.

A weigh tank system by Kahler Automation excels at dispensing a large number of products precisely for small to medium inclusion rates in blends.

Another key issue for ag retailers that has appeared recently and more prominently ties back to supply chain/logistics troubles. According to the 2021 CropLife 100 survey, 60% of the nation’s top ag retailers cited this as their No. 1 concern for business success going into the 2022 growing season.

Combined, says Colt Silvers, Software Sales and Product Manager for Kahler Automation, these two agricultural trends make the prospect for increasingly sophisticated in-plant systems all the more appealing. “The market for in-plant systems is strong in 2022,” says Silvers. “Automation is now being viewed as an essential instead of a differentiator. With labor and supply issues being felt across the industry, accurate and efficient processes are vital to retailers’ success.”

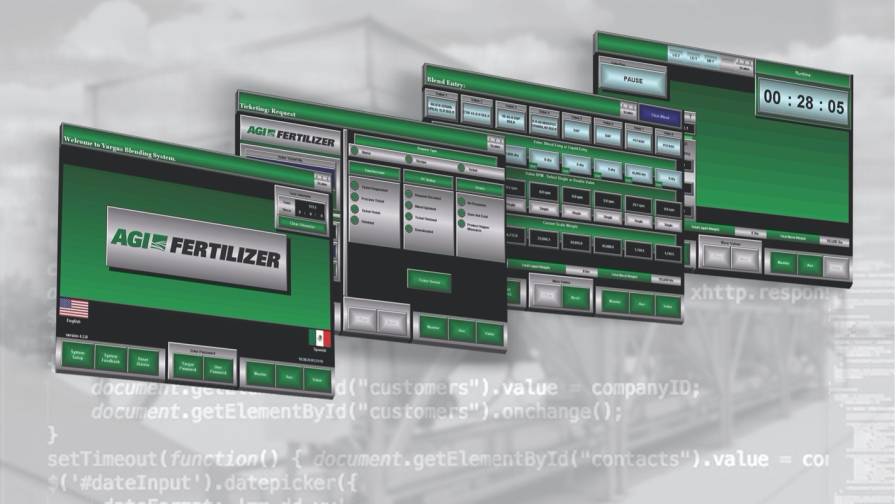

Josh Woods, Controls Engineering Manager at AGI Fertilizer, agrees with this view. “At AGI, we see the in-plant systems market outpacing the fertilizer market in general as supply chain and labor headwinds continue to drive the demand of a more automated plant,” says Woods. “Furthermore, consolidation and decentralization in the industry coupled with the necessity for data to maximize margins we believe is leading the industry to focus on systems with new investments.”

According to Silvers, Kahler’s own market feedback identifies input prices, supply chain interruptions, and labor availability as the Top Three challenges facing its customers in today’s market. “These are tough issues, but they are issues that our systems are designed to improve,” he says. “With soaring input prices, longer lead times, and fewer workers, it is critical that retailers manage their inventory accurately with efficient processes. Kahler Automation systems utilize legal-for-trade measuring devices to ensure precision dispensing while communicating with the top enterprise resource planning and agronomy software packages to reduce data entry and maintain an accurate inventory. Kahler also offers unstaffed solutions for scale automation, liquid loadout, and liquid receiving to maximize each employee’s productivity.”

Longer Lead Times

Besides these trends, says Silvers, ag retailers are having to anticipate longer lead times in their overall plant operations to keep pace. “Retailers’ planning cycles have been extended over the past year and most are now looking further into the future when considering projects,” he says. “Our approach has been and will continue to be proactive as we work with our customers earlier in the process to ensure complete satisfaction.”

In part, several of these market drivers first appeared in the ag retail space during the 2021 growing season. Indeed, when CropLife® magazine looked at this market segment during its March 2021 report, many participants noted “the move towards automation” as the key motivator of industry.

Dan Murray, Owner of Murray Equipment Inc. (MEI), also sees full end-to-end automation as a key trend. “Automation comprises several components: The hook into the back office/agronomy software, the operator interface, and the equipment control,” says Murray. “Each component of automation provides an opportunity to both increase the value to the customer and gain operational efficiencies. At MEI, when designing a new or upgrading an existing in-plant system, we pay close attention to these three areas and the implications for that retailer’s goals and strategic advantages.”

And this hasn’t changed moving into 2022, says Kahler’s Silvers. “Retailers are now aware of the value that comes with automation, and as organizations continue to add services and grow, that value also grows exponentially,” he says. “The recent trend of mergers and acquisitions highlights the value to be captured with automation. With centralized agronomy hubs managing larger inventories, precision is no longer a luxury; it’s now a necessity. However, the efficiencies gained through automation at both dry and liquid facilities are very attractive to retailers of all sizes who are striving to increase value while navigating issues with labor and supply.”

From Kahler’s perspective, the company has in-plant systems that can help tie into all of these market trends, says Silvers. “At Kahler, we offer an extensive line of quality standard products as well as custom designed solutions,” he says. “Kahler is well known for all aspects of blending and loadout solutions ranging from dry towers to floor mixers and liquid blenders to unstaffed loadout. This flexibility allows us to accommodate specific workflows for our customers because not all facilities are the same.

“Kahler’s proprietary software is the cornerstone to each of our systems,” he continues. “Our software products are designed for integrations so our customers can be confident that all their trusted partners will be part of the solution, allowing them to operate at peak efficiency. Our software subscriptions include regular updates, 24/7 support, and online knowledge base to ensure a flexible and rapid response to our customers’ needs.”

At MEI, says Todd Scobie, Sales and Marketing Manager, the company has the ICS system. “MEI’s in-plant systems allow retailer to get the right product quickly and accurately to the right fields,” he says. “With automation, retailers can provide a greater number of blends (including hot loads) and agronomy services without sacrificing speed. ICS software and electrical engineers are in constant communication with the mechanical engineers at MEI and other ICS distributors to continually bring innovation to the market. This means ICS controls are intuitive, easy to use, and designed directly to fit the workflow requirements of our customers.”

SureTrack Plant Manager has the ability to run the blenders and receiving systems and monitor their speed and accuracy, as well as monitor for maintenance or potential downtime interruptions.

From AGI, there is the SureTrack Plant Manager. “AGI Fertilizer System continues to advance the automation capabilities to improve the customer experience,” says Woods. “As the only manufacturer of fertilizer equipment with a full in-house automation department, AGI Fertilizer Systems designs and installs software designed to improve efficiencies and safety in and around the plant. From maintenance reminders, inventory control to track products in real time, and customized integration to create a seamless interface with agronomy and ERP software, AGI has all your fertilizer automation needs covered.”

See all Retail Remedies content here.