Ag Retail Distribution Feels Pressure from New Concerns

There’s a famous Chinese curse that’s rather straightforward when it comes the events of the day: “May you live in interesting times.” In other words, this statement hopes listeners will be facing myriad new challenges and opportunities whenever in time they happen to be vs. being stuck in some kind of unchanging, stagnant daily/yearly routine.

But it’s doubtful, however, that the ancient Chinese philosophers that gave birth to this curse could have imagined how it might apply to the current year the world is living through in 2020. In fact, referring to 2020 as “interesting” in the context of the many societal and business changes that have occurred seems like a gross understatement.

“I think I speak for many when I say the world has never seen a year like 2020 in terms of disruption,” says John Oster, Sales Specialist at The Morral Companies, Morral, OH. “After everything the agricultural industry went through during 2019 – with extreme weather and trade issues, for instance – I wouldn’t have thought 2020 could be more disruptive. But here we are.”

And in truth, the ag retail distribution channel was already undergoing some extreme challenges when it came to marketplace dynamics. This is why CropLife® magazine first started covering this area as the primary focus of our October issues a few years ago.

“We are definitely in a period of change in the market,” said Dave Coppess, Executive Vice President of Sales and Marketing for Heartland Co-op, West Des Moines, IA, back in the October 2017 edition of CropLife (our first look at this important topic). “There are new business models beginning to pop up, and they are threatening to destroy or at least radically alter the old ones.”

A few years later in 2019, Steve Rao, CEO of Farm Market iD, echoed a similar thought to Coppess. “The retailer part of agriculture will probably change dramatically in the next few years,” said Rao. “For the most part, this part of the market has a business model that hasn’t changed for many, many decades. But it will probably need to [do so] to survive going forward.”

And the Survey Says . . .

As we’ve done during the past four years now, CropLife magazine is once again taking an in-depth look at the State of Retail Distribution. We detail how the marketplace is addressing such challenges as e-commerce and some examples of distribution changes that have occurred outside the U.S. in other countries around the globe that might foreshadow similar shifts in the domestic market as well. But first, like we did in this November 2019 article, let’s start with some opinions from the readers themselves, courtesy of the 2nd annual State of Retail Distribution survey (see survey charts in the slideshow above).

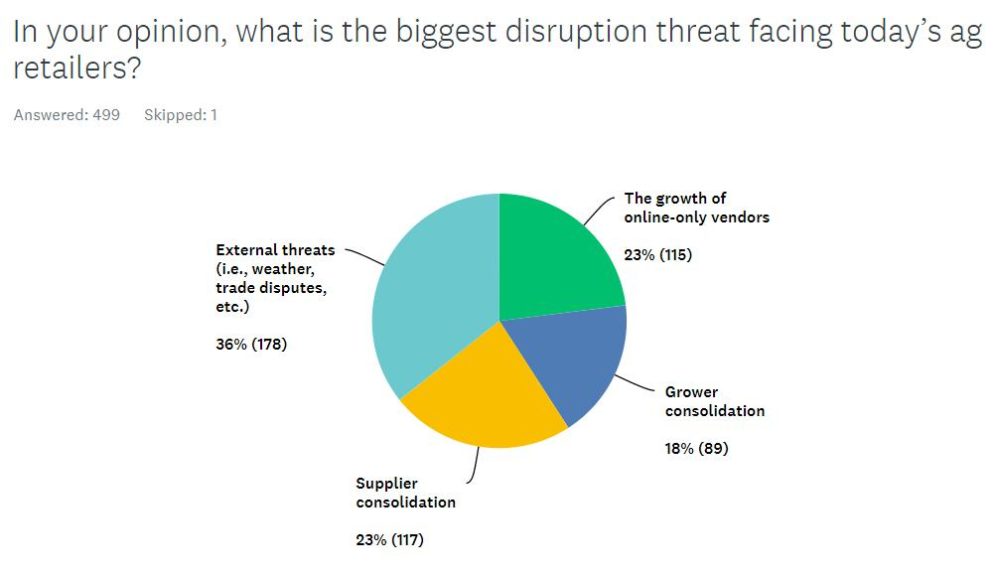

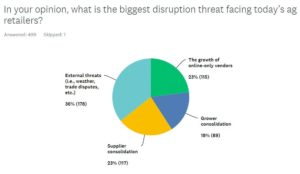

To kick off the survey, we asked ag retailers what the biggest disruption threat facing their operations today in 2020 was. For some perspective, in our 2019 survey, 40% of respondents said this was coming from a familiar source for the sector – external threats. Examples for this listed in the 2019 survey included weather, commodity prices, and trade tariffs. Finishing a distant second was the growth of online-only vendors (i.e., e-commerce) at 23%, followed closely by grower consolidation at 21%. Supplier consolidation finished last as the biggest disruptor at 16%.

In the 2020 survey, there wasn’t much change in these percentages. According to this year’s results, 36% of respondents still view external threats as the biggest market disruptors, down only a slight 4% from the year before. The disruption being caused by online-only vendors remained static at 23%. But there were some changes when it came to supplier vs. grower consolidation.

According to the 2020 survey, 23% of respondents now view supplier consolidation as a big disruptor to their business models going forward, up 7% from the 2019 survey results. Meanwhile, grower consolidation is now viewed as the biggest disruptor to the ag retail distribution channel by only 18% of respondents, down 3% from the previous year.

Of course, this being 2020, one of the biggest external threats facing the ag retail distribution marketplace – and indeed, the world at large – was the coronavirus pandemic. From late 2019 to early 2020, this novel virus and the diseases it caused quickly spread across the entire globe. By mid-March, much of the U.S. essentially closed down schools and businesses to keep the spread of COVID-19 from overwhelming the nation’s health care systems and hospitals. Despite this, several hundred thousands of Americans were ultimately killed by the disease, with millions more being diagnosed as having the virus in their bodies at some point. Suffice to say, this caused plenty of market disruptions to the general economy.

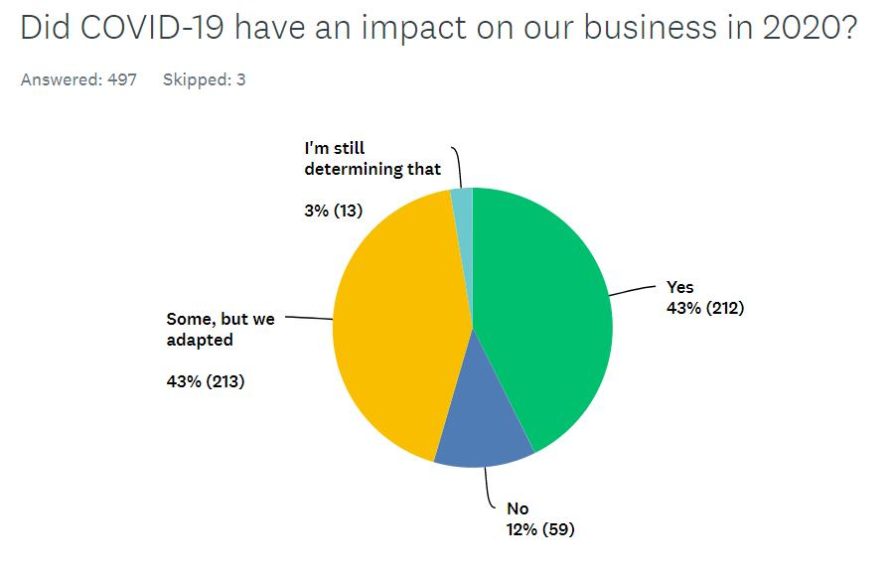

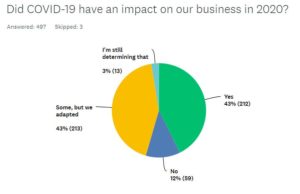

In the ag retail market, the severity of COVID-19 was also present. According to the 2020 State of Retail Distribution survey, 43% of respondents definitely thought the coronavirus pandemic had had a “major impact” on their businesses during the spring season. Another 43% said the virus had caused “some impact” on their operations during 2020, “but we adapted.” Two percent said they were still “trying to determine” the impact COVID-19 would have on their companies. The remaining 12% said the coronavirus pandemic had “no impact” on them.

Part of the reason COVID-19 might not have seriously damaged the nation’s ag retail distribution channel was that the industry was declared “an essential business” during the spring 2020 closure cycle. This meant most ag retailers continued to do business as they had in the past, with a few modifications.

“Despite the COVID imposed conditions, we are having a very good spring,” wrote Bruce Vernon, CEO of The Equity in Effingham, IL, in an April 2020 email. “[We will] likely have record crop input volumes, with grain, feed, and energy all up from last year. Corporate headquarters, which normally has about 50 to 60 employees, has been down to five or six for the last month. [The others are] working from home or on rotational staffing.”

Crop Protection Product Questions

Two other major external threats to the ag retail distribution channel during 2020 involved the crop protection products category and the nation’s courts. In particular, two popular herbicides – glyphosate and dicamba – garnered most of the attention.

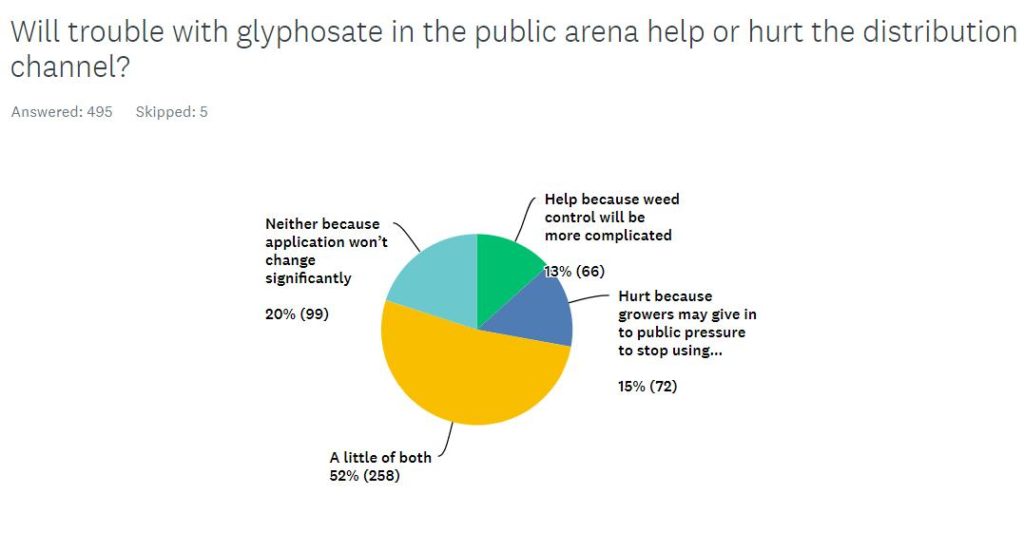

For glyphosate, this has been a long running battle. Since Bayer formally acquired Monsanto a few years back, the company also inherited several hundreds lawsuits regarding the popular herbicide. By the end of 2019, this had ballooned to more than 100,000 according to estimates, spurred on by a pair of multi-million dollar judgments against the company in California courtrooms. By the middle of 2020, Bayer had in place a proposed settlement to address most of these cases. However, many market watchers have openly wondered if glyphosate use in agriculture could ultimately survive all this “bad” popular press coverage.

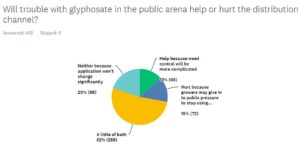

When asked if all this negativity regarding glyphosate would help or hurt the ag retail distribution channel, respondents were almost equally split. Thirteen percent believe that glyphosate questions will help their business by making weed control more complicated and varied, increased sales of alternative herbicides and related services. Another 15% indicated they thought these kind of questions would hurt their sales as their grower-customers came under increased public pressure to “drop glyphosate on their farms.” However, the vast majority, 52%, believed “a little of both of these scenarios” would end up playing out for ag retailers going forward into 2021 and beyond. The remaining 20% believed glyphosate questions would neither help nor hurt their businesses “because application won’t change significantly.”

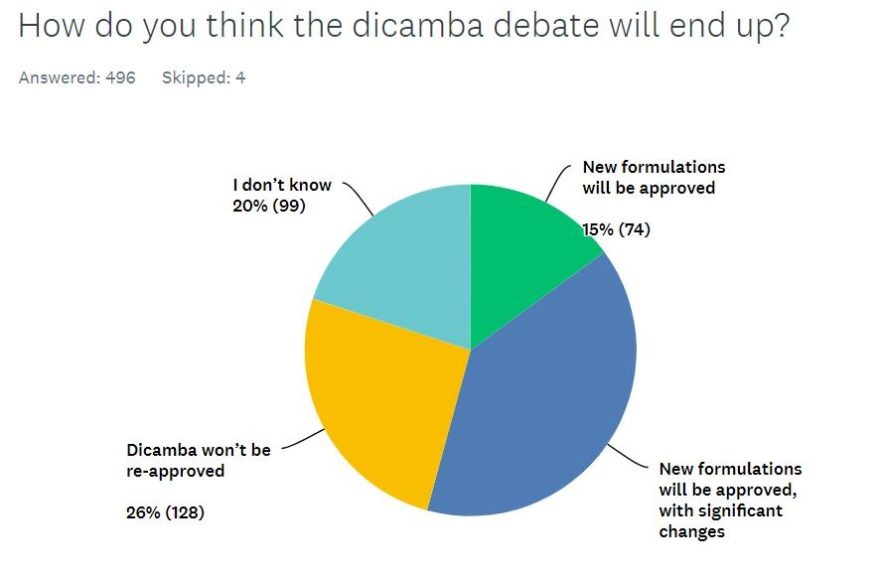

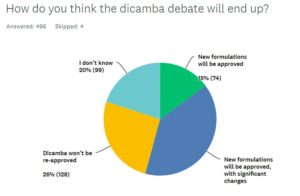

The other big crop protection product news of 2020 involved dicamba. In early June, the Ninth Circuit of Appeals ruled that EPA’s registration of three dicamba formulations from 2018 was invalid and the product label was vacated. Ag retailers and their grower-customers had until the end of July to use up their supplies of dicamba for the season. But what happens now for the popular herbicide?

According to the survey, 54% of respondents believe dicamba will gain re-approval from EPA before the end of 2020. Fifteen percent of this group believe that this approval will take place with “new dicamba formulations,” with the remaining 39% convinced these new formulations will feature “significantly changes from the previous ones.” Still, more than one-quarter (26%) are preparing for a world without dicamba, believing that new EPA registrations will not take place. The remaining 20% simply said they “don’t know” what will happen with dicamba re-registration efforts at this point.

Future Trends

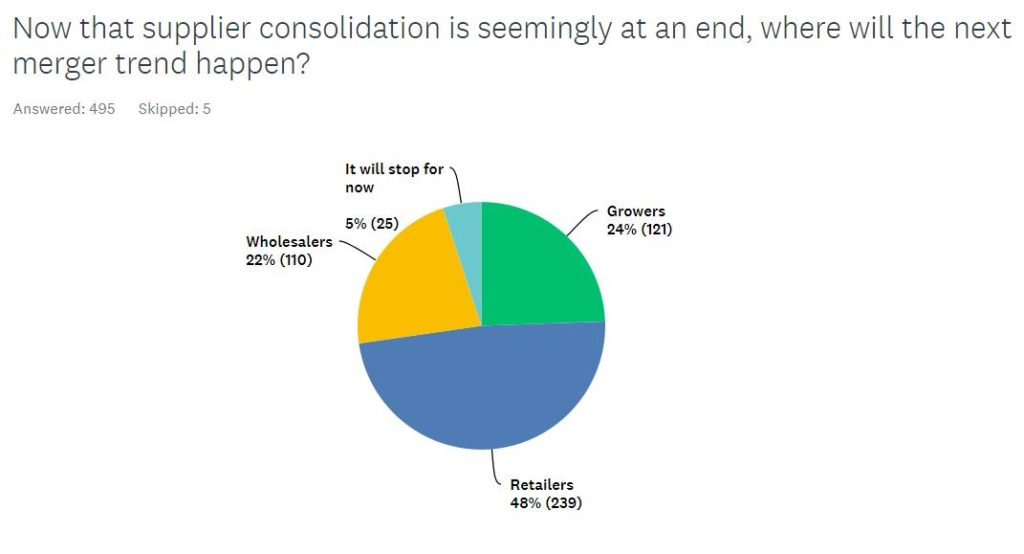

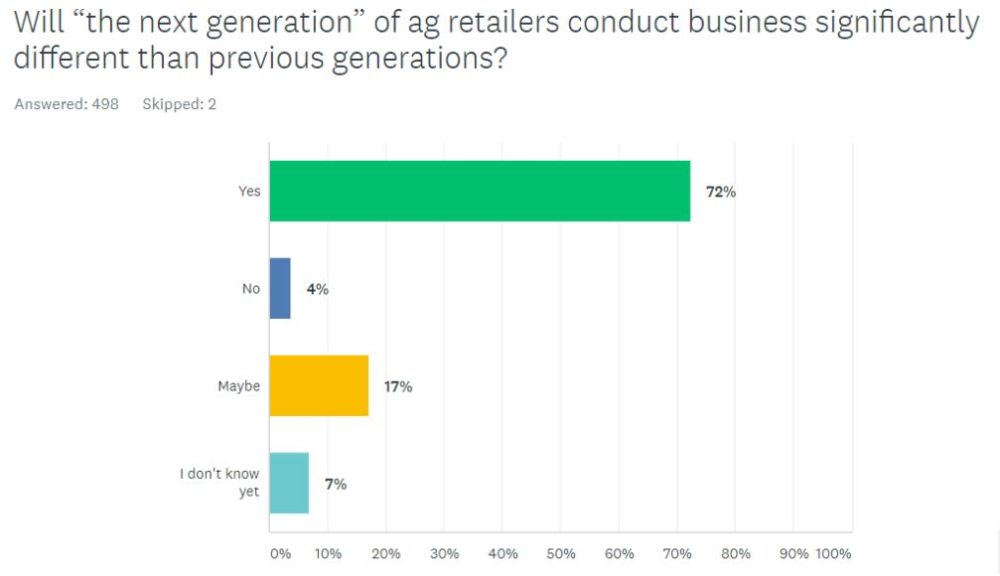

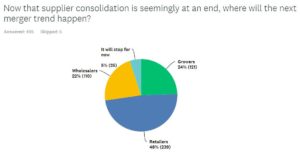

With most analysts believing the major supplier mergers of the past few years now being complete, where will the next industry consolidation trend take place? According to the survey, ag retailers. When the results were calculated, 48% of respondents said ag retailer is where consolidation will happen – something borne out as major CropLife 100 retailers have merged or announced mergers in recent weeks (see p. 6 for more details on this trend). Another 25% think grower consolidation will now come to the forefront, with 22% keeping an eye on wholesaler mergers. The remaining 5% of respondents believe consolidation in the ag industry “will stop for now.”

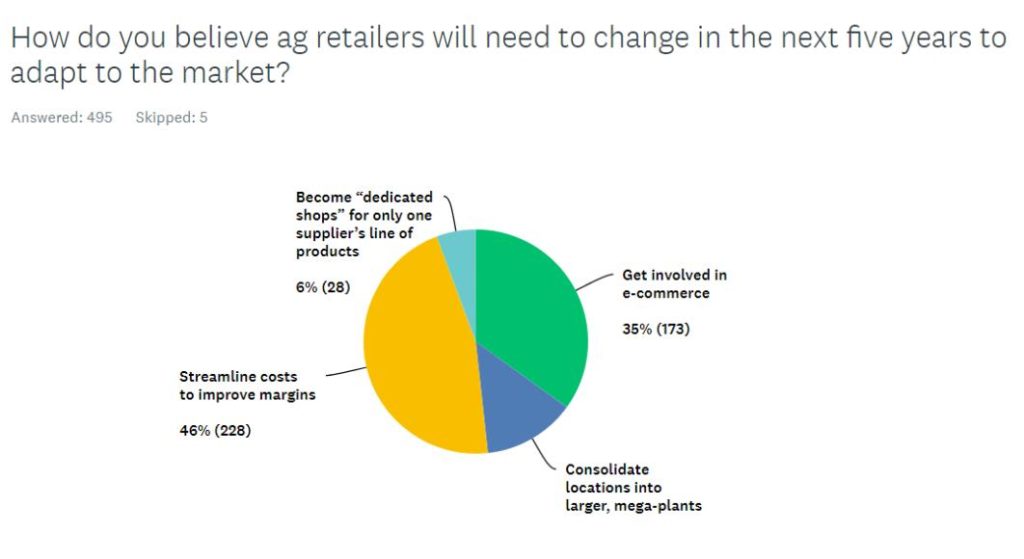

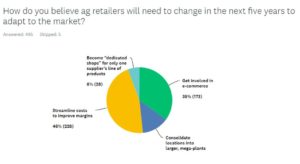

Looking more closely at the future for the ag retail distribution channel itself, the survey asked respondents to indicate how dealerships and cooperatives would need to change their operations to survive over the next five years. Forty-six percent thought companies would streamline their costs to improve margins, with another 35% believing getting more heavily involved in e-commerce business models would be the correct path forward. The remaining 19% were split between consolidating their smaller locations into larger mega plants (13%) and becoming dedicated shops for only one supplier’s line of products (6%).

Survey Statistics

The 2nd annual CropLife magazine State of Retail Distribution online survey was sent to readers in August and early September 2020. In total, there were 499 surveys returned with valid answers. In terms of breakout, 25% of the respondents identified themselves as being cooperatives. Another 25% said that their companies were classified as independent retailers. Nine percent indicted they were part of a national chain of ag retailers. The remaining 41% identified themselves as “others.”

Finances-wise, 47% of the respondents said their companies recorded less than $50 million in annual sales during the 2019 growing season. Another 24% said their companies had annual sales between $100 million and $900 million. Sixteen percent indicated they had annual sales of more than $1 billion during 2019. The remaining 13% of respondents had sales ranging from $50 million to $99 million.

As to where these respondents were located, the vast majority (63%) were based in the Midwest. Another 18% said their operations were “out West,” with another 12% located in the Mid-South. The remaining 7% said their companies were based in the Northeast.

CropLife would like to thank everyone that took part in this year’s survey. Your insights are appreciated!