Agriculture 3.5: A Bumpy Road Ahead

You may have read my article a few years ago on Agriculture 3.0, which is a term I coined to describe the big evolution going on in agriculture as we move from scale and consolidation driven agriculture to a new paradigm where sustainability, environmental consciousness, and heightened focus on data driven decision-making play much bigger roles.

As with any evolution of this scale, there are bumps along the way. The German military strategist Helmuth von Moltke once noted that “no battle plan survives contact with the enemy.” I think Mike Tyson might have said it better: “Everybody has a plan ‘til they get punched in the mouth.” It’s probably safe to say that is the sensation many in agriculture are feeling these days.

I’d like to describe the biggest bumps agriculture faces (as well as some opportunities that may present). Agriculture 3.5 describes the same fundamental destination as Agriculture 3.0, but with a number of notable changes that could impact the best strategies to pursue.

Agriculture 3.0

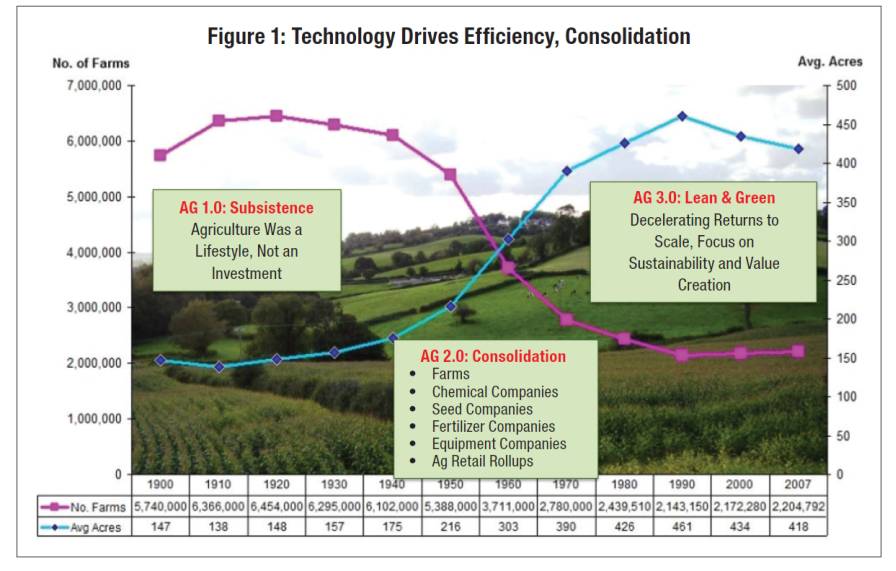

In case you missed the first article, Agriculture 3.0 described the transition in agriculture we are seeing, best exemplified by the U.S. farm consolidation timeline show in Figure 1.

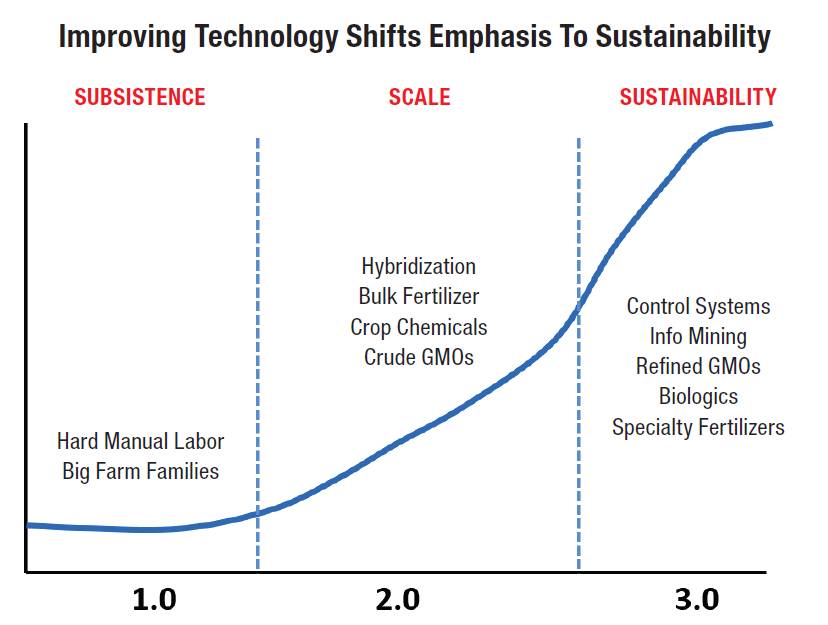

As hybrid seed corn and agrochemicals were developed in the 1940s and 1950s, the farm economy went through a huge productivity boom that resulted in dramatic increases in farm size and dramatic consolidation of farms and farm inputs. Over the past few decades this consolidation has slowed as a handful of input suppliers dominate the industry and farms have reached a size where getting efficiencies from further scale is far more difficult.

In this environment, the focus is slowly shifting from scale to sustainability, with a focus on being more efficient and less wasteful with nutrients and chemical use as the rising costs of inputs begins to align environmental and economic incentives (see graph below). The integration of precision farming tools and biologics is also allowing a level of control most of us never thought possible.

From Agriculture 3.0 to 3.5:The Five Big Bumps

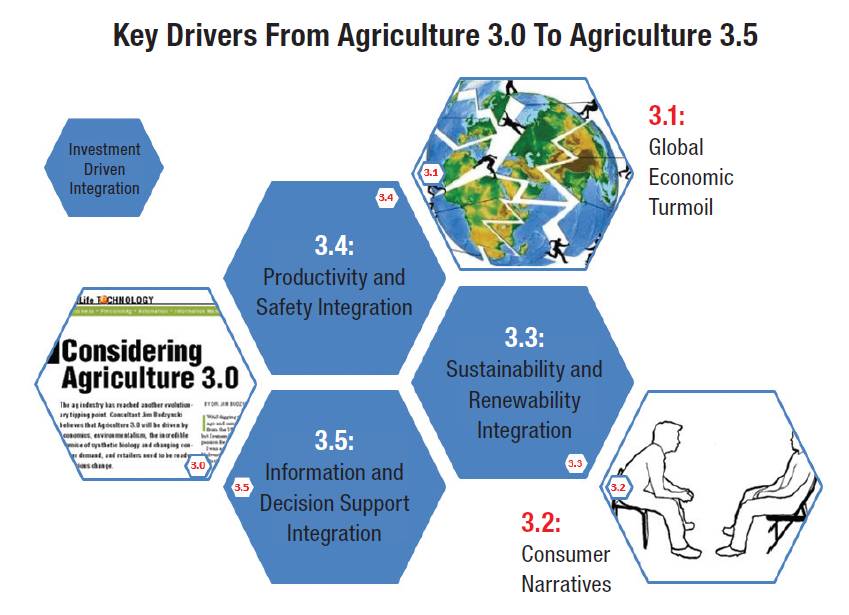

While the direction outlined by the Agriculture 3.0 article is unchanged, in my view there are five key bumps we are likely to feel during this transition. While the first two can be described as “external bumps” that will impact our planning, the final three are best described as “internal bumps” that will be greatly accelerated by technology, generational transitions, and the oceans of outside capital seeking to invest in agriculture:

• Bump 1: Global Economic Turmoil. By far the biggest bump, agriculture is not just sustaining a common cyclical downturn. It is a Coincident Downturn, where a cyclical downturn happens to coincide with secular downturn caused by the ongoing collapse of 30 years of global central bank money printing. This collapse is resulting in rapid de-globalization and a food security mindset that has profound implications for global food trade (and the prosperity of U.S. agriculture). Is it time to give up the “maybe next year will be better” planning approach and start actually planning for what has fundamentally (and perhaps irreversibly) changed in our industry?

• Bump 2: Consumer Narratives. There is a new sheriff in town — millennials now outnumber baby boomers in the U.S. These consumers, perhaps due to their digital upbringing, are far more profoundly impacted by narratives than prior generations. Whether we are talking about GMOs, organic farming, or honey bees, the ongoing challenge of mainstream agriculture proponents to effectively communicate with consumers (and regulators) can be traced to our inability (or unwillingness?) to reduce our messages to a 140-character Twitter feed. How long will our industry characterization of skeptics be that “they just don’t understand”? What part of helping them understand do we own? Can we develop our own narratives to compete with clearly misinformed ones?

• Bump 3: Sustainability/Renewability Integration. As an industry, we can do better than first generation GMOs and renewables. We have spent a ton of (investor) money over the past 15 years developing a wide range of dramatically enhanced technologies that can add to the sustainability of our industry; most are only very slowly being integrated or replacing “mainstream” technologies, and the tendency of both farmers and suppliers to “stick to their knitting” in a downturn (see Bump 1). This slows adoption ever more. Outside capital is available to make this happen — will we drag our feet until investors give up and regulator mandates take over?

• Bump 4: Productivity/Safety Integration. Great progress has been made in developing productivity-enhancing tools for agriculture. Biologicals and new vaccine technology are but two recent examples. Unfortunately, integration of those tools is being slowed by the same forces impacting sustainability (especially the industry downturn). There are also economic and structural challenges, as many of these new technologies have to try to work their way through a highly consolidated ag input channel that is often more focused on efficiency than innovation. Are these channel players “fighting the last war”? Will investors keep funding new technology when they develop great products and cannot get channel support because it competes with their “house brands” (or a product one of their big suppliers sold them in a “bundled” offer)?

• Bump 5: Information and Decision Support Integration. Precision agriculture has great promise to revolutionize this industry. It is also a mess of competing (and often incompatible) technologies and business agendas. There are many tech startups who remind me of 1999 — no compelling reason they should even exist. We are trying to “build by committee” an entirely new sector that may well drive the future of the input (equipment, fertilizer, chemicals) industries. Of course, because of this economic impact it’s a self-appointed committee where the deepest pockets try to drive their revenue and profits at the expense of industry productivity, efficiency, and perhaps even food safety. Can the ag industry figure out how to let capitalism and innovation co-exist with enough structure and standardization to allow new technologies to actually get to market? Will we waste 15 years while a bunch of incompatible platforms fight it out and great new tools die on the vine?

As you can probably tell from this introduction, each of these bumps deserves a more detailed discussion. In the coming months I will dig deeper in each of these bumps to perhaps help a few ag industry players who’ve recently been “punched in the mouth” to try and figure out what their plan is now.