2023 AgTech Venture Capital Investment and Exit Round Up

Last year, our analysis of Crunchbase data shows 762 AgTech startups raised a total of $5.7B. This represents a 47% decrease in funding and a 4% decrease in deals from 2022. There were 28 AgTech exits last year, all through M&A transactions. This is down 15% from the 33 AgTech exits from 2022.

Key Takeaways from Last Year and Predictions for 2024

For AgTech startups, 2023 was a very challenging year. In fact, it was a challenging year for the ag industry in general. The performance of agriculture stocks was broadly down. The VanEck Agribusiness ETF, which invests in a basket of the publicly traded ag stocks, was down approximately 8% in 2023, while the broader S&P 500 index was up about 23%.

Can last year’s challenges tell us anything about what to expect in 2024? There will be varying forecasts depending on whether a company has already raised capital or not. For newly launched AgTech startups, 2024 should be a better year for fundraising. The stock market is up, inflation is cooling, and falling interest rates should encourage more startup investing.

For AgTech startups who have previously raised capital in what hindsight appears to be the bubble years of 2021 and 2022, the landscape will likely be more challenging. Startups often try and raise enough capital for two years of operations. After that they are looking to do three things: 1) exit via M&A or an IPO, 2) become cash-flow positive and no longer require cash infusions to operate, or 3) raise more capital.

In 2021, over 600 startups raised $12.2B in funding. Over the last two years, only 61 AgTech startups have exited. This leaves hundreds of previously funded startups looking to either reach cash-flow break even or raise more capital.

With only $5.7B raised in 2023, less than half what was raised in 2021, many startups are struggling to raise more money. Getting to cash-flow break even only works for certain types of startups. Depending on where a company is in the development of their technology, getting to break even might not be possible. This leaves limited options.

The next 12 months will likely result in many older AgTech startups unable to raise additional cash and be forced to explore other strategies. There are a few typical moves when you cannot raise more capital including: 1) going out of business, 2) merging with another startup to try and increase revenues or extend runway, or 3) try to get acquired by a strategic. The success of these moves for AgTech startups hinges on their strategic positioning to potential acquirers. Can they create a sense of urgency for an acquirer to move fast enough? It will be a fascinating 2024 to see how this all shakes out.

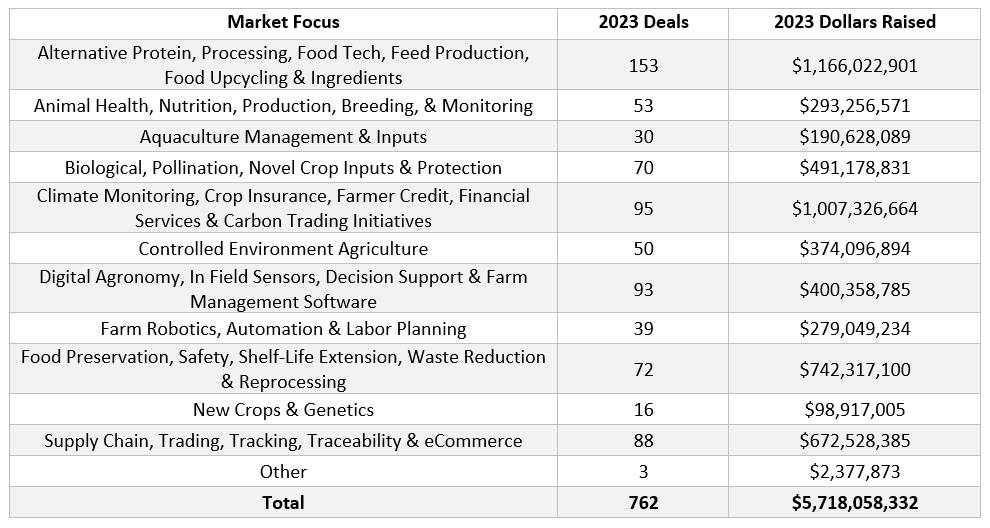

AgTech Venture Investments

Below is a breakout of the deals and dollars that flowed to different sectors of AgTech last year:

The only category that grew in total dollars invested in 2023 as compared to the previous year was the food presentation and waste reprocessing. There were many startups that raised capital to repurpose ag waste in 2023. The biggest decline last year was in the controlled environmental agriculture space where funding was $2.1B in 2022 verses just $374M in 2023.

The 10 largest AgTech investments last year were as follows:

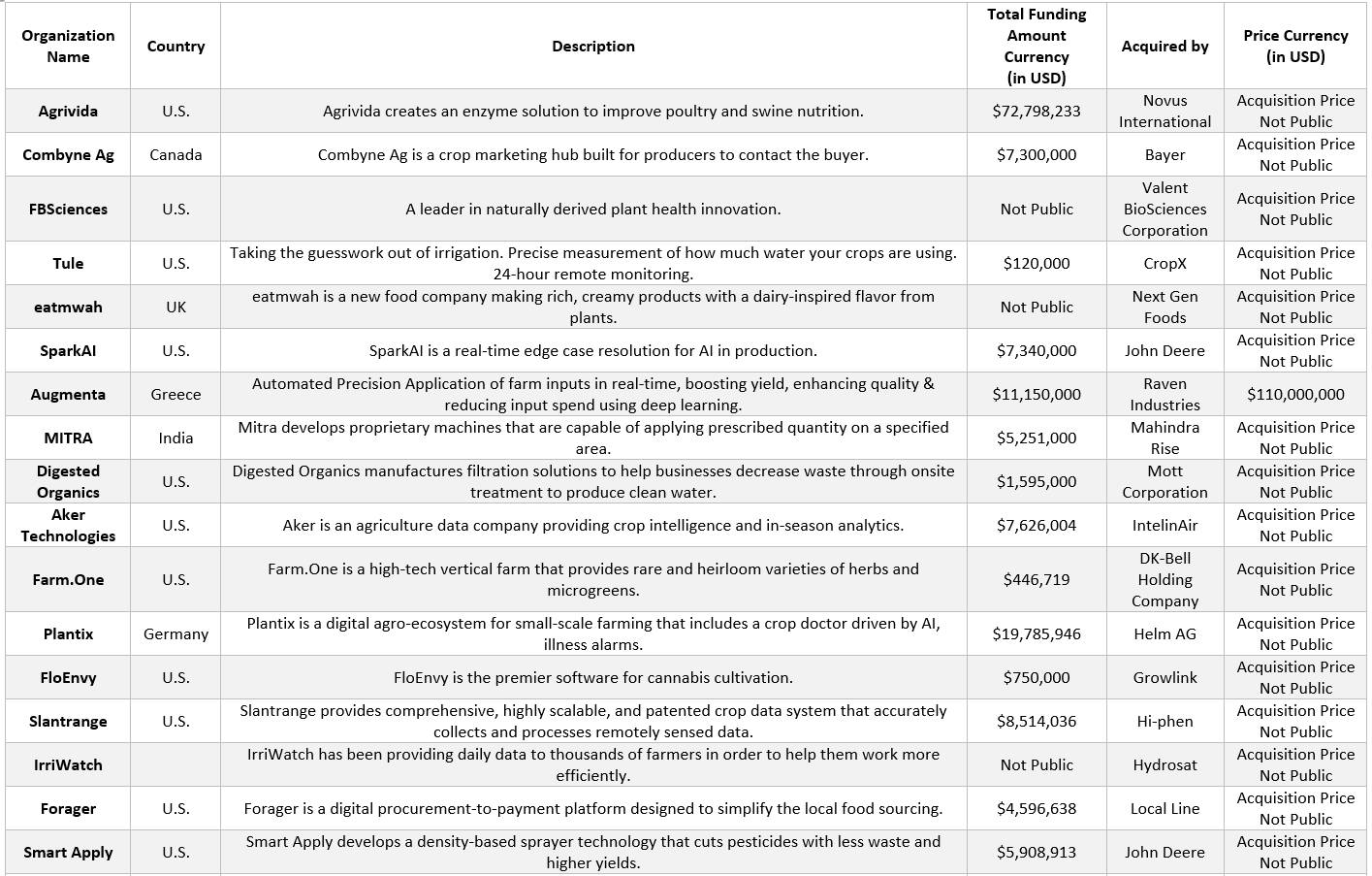

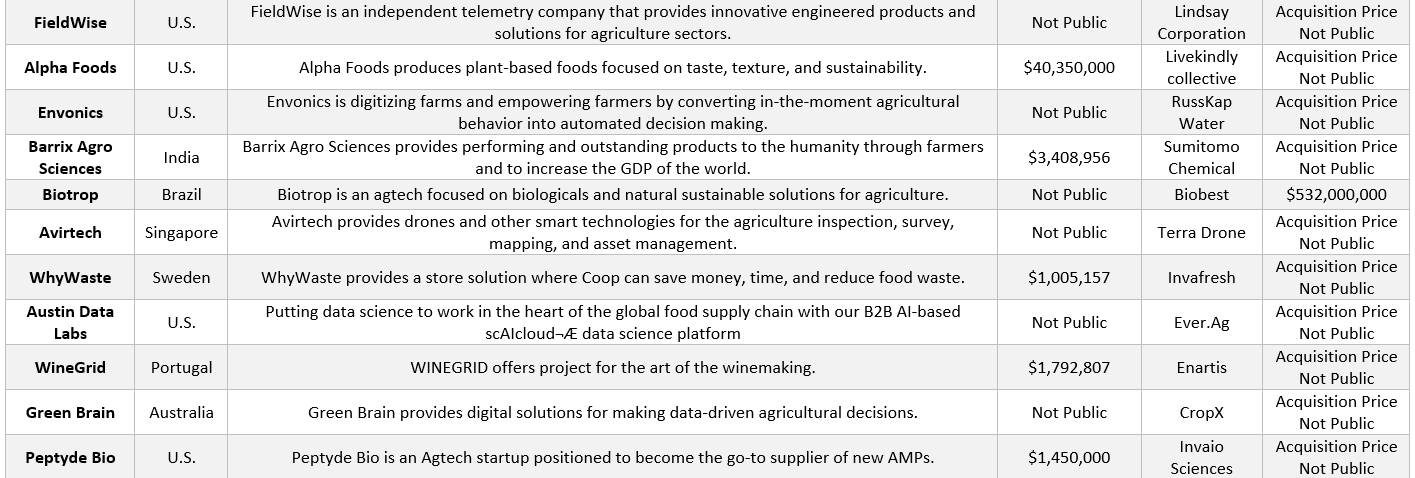

AgTech Startup Exits

Below is a list of the 28 AgTech exits from last year: