Q2 2024 AgTech Venture Capital Investment and Exit Round Up

Last quarter, our analysis of Crunchbase data shows 190 AgTech startups raised a total of $1.6B. This represents a 15% increase in funding while the number of deals stayed flat from Q1 2024. There were six AgTech exits last quarter, all through M&A transactions.

Key Takeaways from Last Quarter

The AgTech sector saw increased venture investment last quarter, mirroring the overall trend in venture capital. AgTech maintained a steady 2% share of the $79B of venture dollars invested globally.

All six exits last quarter were through M&A. According to a recent Axios article using Pitchbook data, early-stage startups accounted for over 70% of all M&A activity in the first half of this year, meaning most acquisitions are occurring before a startup company raises a Series B round.

Public agribusiness companies have remained quiet on M&A so far this year, but earnings calls show more optimism for the second half of 2024 as challenges ease.

Whether this optimism leads to increased AgTech M&A, and at what stage, remains to be seen. Early-stage startups typically cost less but take longer to become profitable, while later-stage startups should be further along on commercial development but have often raised more capital and cost more.

Regardless of stage, AgTech needs a boost in M&A activity. Halfway through 2024, AgTech exits are on pace for a 21% decline from 2023, and nowhere near the 46 exits that occurred in 2021.

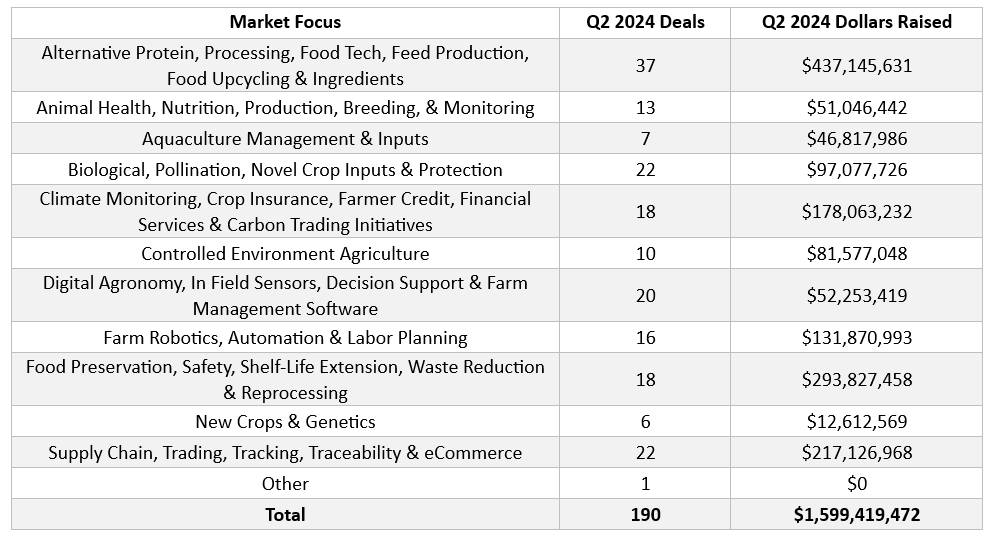

AgTech Venture Investments

Below is a breakout of the deals and dollars that flowed to different sectors of AgTech last quarter:

The 10 largest AgTech investments last year were as follows:

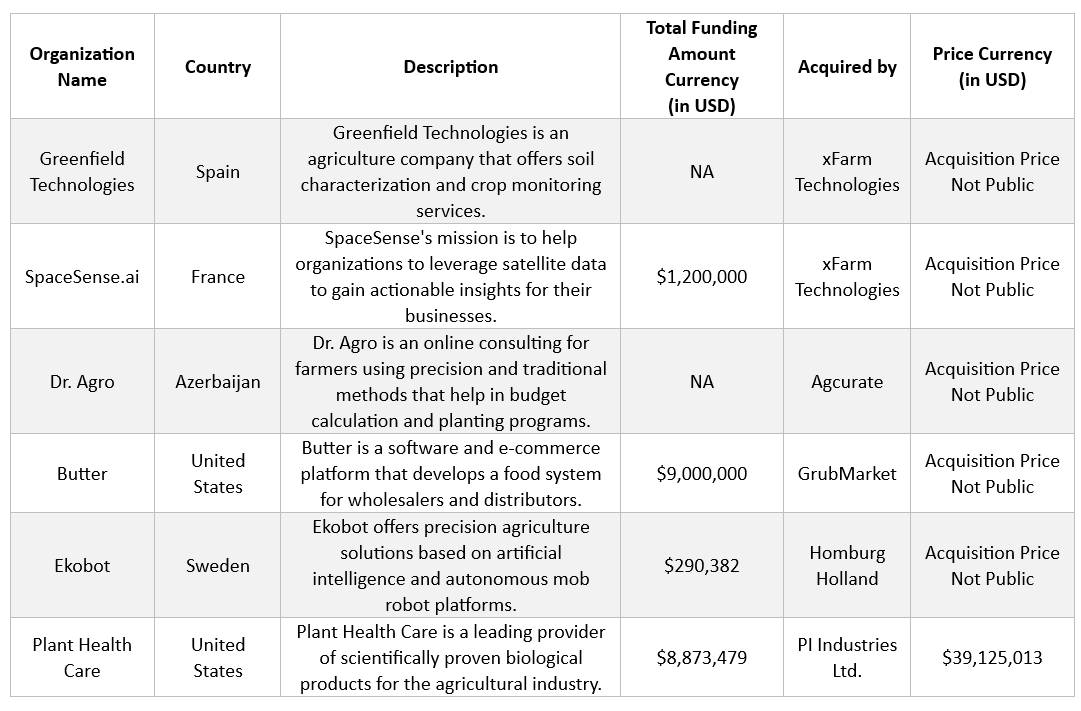

AgTech Startup Exits

Below is a list of the six AgTech exits from last quarter: