For Airbus in Agriculture, the Sky is Not the Limit

The running joke is whether Airbus is going to make tractors fly. Such is life (c’est la vie) for a technology company long associated with airplanes but not so much with agriculture.

“It’s not the first brand you think of when you think of agriculture,” acknowledged Charlotte Gabriel-Robez, the company’s Agriculture Portfolio Manager, sitting in the offices of the Intelligence business line of Airbus Defence and Space, located quite appropriately on the rue des Satellites in the French high-tech capital of Toulouse. Yet the company has been involved in agriculture for more than three decades and has made significant investments in the sector over the past several years, she said.

GPS-guided precision agriculture would not be what it is today without Earth observation satellites, of which Airbus is the oldest commercial operator, dating to 1986.

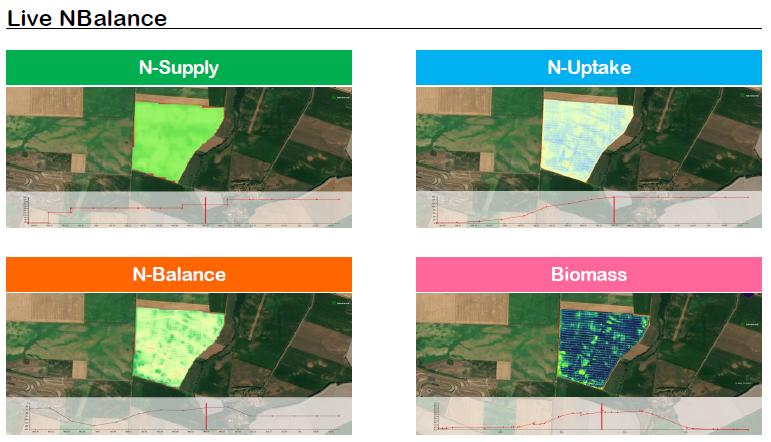

That tradition continues with the expected launch beginning in 2020 of four Pléiades Neo satellites, whose new spectral bands and high-resolution imagery will drastically improve the measurement of chlorophyll content so important for managing nitrogen (N) application. Management of N is also at the heart of Live NBalance, a service Airbus developed with John Deere to merge satellite data with tractor data to more precisely monitor intra-field N balance during the growing season. The technology received an innovation award from SIMA 2019, the Paris international agribusiness show held Feb. 24-28.

Meanwhile, Airbus’ imagery has been used for decades in partnership with the likes of USDA; SAGARPA, Mexico’s ministry of agriculture; the European Commission; and the Food and Agriculture Organization. Those contracts helped to set up and monitor agriculture policies, management and plan ag land administration, optimize water sharing, and secure food supply. Commercial partners include J.R. Simplot for its SmartFarm precision agriculture service, the food giant Nestlé, and SGS Unigeo in Brazil, to name a few.

The company also has made significant inroads over the past decade and a half with Farmstar, the leading precision agriculture service in France used by more than 16,000 farmers and offered through 40 cooperatives and resellers. Farmstar, developed in cooperation with Arvalis-Institut du végétal, a leading agronomic institute in France, is a “best seller,” Gabriel-Robez said. It’s a decision-support tool that combines satellite, UAV, and aerial imagery with other data points, including local weather, soil type, crop models, and as-planted crop information to provide insights on crop growth stage; risk for disease and lodging; and whether, how much, and when to apply N in-season.

“Farmstar has also helped us to understand what it takes today to be a good service provider in agriculture,” she said. “But to simply replicate the product outside of France and globally would be difficult and require a lot of time and effort. Airbus is very good at satellite imagery, but we are not farmers. We would need to again partner with a local agronomic institute in order to be able to offer the same level of service quality in each country.”

Enter the company’s next phase: building on its tenure in agriculture by sharing technological expertise with the many precision shareholders at other tech companies, ag retailers and distributors, and precision-focused growing operations. At the heart of Airbus’ services for agriculture, Gabriel-Robez said, is “the capacity to draw from the pixel very specific crop information. Our vision is to take it to the next level” by placing imagery and the company’s premium analytics in the cloud and making them far easier to use by everyday precision practitioners. “The satellite is great,” she said, “but it’s never the end of the story for the farmer.” Today, with numerous satellites in the sky offering improved capacity for crop monitoring thanks to greater revisit cycles and finer spectral bands, “we can go into areas where a commercial, robust, reliable service of yield prediction and disease identification is of the essence.”

Verde: Plug-and-Play Imagery API

A new product called Verde will be of particular interest to precision service providers. Verde is a service provided exclusively via API capable of transforming raw imagery data from multiple sources — existing satellites now, and in the near future high-resolution Pléiades Neo satellites plus drones — into plug-and-play crop analytics, fit for ingestion into any farm management information system (FMIS). Tapping the knowledge of Airbus’ team of on-staff agronomists to “help translate” the data, plus the company’s growing capabilities in machine learning and artificial intelligence, Verde’s turn-key analytics will be able to characterize the status of a crop through extraction of biophysical information.

“Our customers were asking us to give them the tools to do what they want to do, to ‘cook’ the [imagery] service the way they want to,” said Gabriel-Robez.

Verde will provide a “thread of data” without all the hassle of processing imagery and handling huge and cumbersome files, said Sky Rubin, who is in charge of sales for Airbus in North American agriculture and is based in Fort Collins, CO. The result: in-season crop health monitoring to optimize precision programs and crop production, as well as off-season analysis that the company says can “unlock” previous years’ data to compare outcomes and improve practices.

Airbus has been involved with early adopters of Verde in water and crop input management prior to its launch early this year. While price has not yet been announced, Gabriel-Robez said Verde features a low-cost option meant to be accessible to both big and small users. The service will be adaptable to row crops including alfalfa, wheat, and barley as well as specialty crops like almonds and citrus. “We try to widen, as much as possible, the type of crops covered,” she said. “Our primary analytics work for all crops, and for the most advanced ones our catalog already features 14 crops just for version one.”

Pushing the Ceiling on Drones

More is in the works. This includes Airbus’ Zephyr, the world’s first High-Altitude Pseudo Satellite (HAPS) to fly in the stratosphere, which will start operational service in 2021.

Zephyr, Gabriel-Robez said, is “the best of a satellite and the best of a drone.” It consists of a 100% solar-powered aircraft, flying in the stratosphere at 65,000 feet, which is above conventional air traffic but below satellites, and beams “live video from space” at 18-cm resolution. And like a drone, it can be brought back to Earth so that its sensors can be swapped out. The Zephyr is lightweight and can fly for months at a time.

And while the Zephyr’s live-video capabilities may not have immediate applications for agriculture’s slow-growing crops, Gabriel-Robez notes it could be used to monitor the movement of equipment and machinery in farm fields.

Rubin sees another opportunity: monitoring of oil and gas operations for ag land owners, who — especially in the U.S. — often are in both businesses.

Doubling Down on Agriculture

Two or three years ago Airbus took a serious look at potential growth areas, and one was agriculture and the intensification of farming — that was the driver for the company. And partnerships — not competition — will be the name of the game. “We want to go beyond and are keen to work with key partners in the industry to extend our ag portfolio,” Rubin says.

So it’s safe to say Airbus is bullish on the future of precision agriculture. “With the amount of investment, R&D, and staffing we have in place,” Rubin said, “we’re positioned to be a key provider in agriculture for years to come.”