A Strong Recovery Year for Seed Treatment Sales

It’s no secret that among all product input segments, seed treatment has historically been a good one for the nation’s leading ag retailers. In fact, for many years in our magazine’s annual CropLife 100 survey, the seed treatment segment usually saw approximately 50% of respondents recording sales increases each and every year.

The overall reason for this is simple to understand, says Tara Pirak, President/Owner of Valley Ag Supply, Gayville, SD — seed treatments work as advertised for grower-customers. “Customers are seeing fewer insects in their fields due to seed treatments,” says Pirak. “And aphid spraying has been virtually eliminated.”

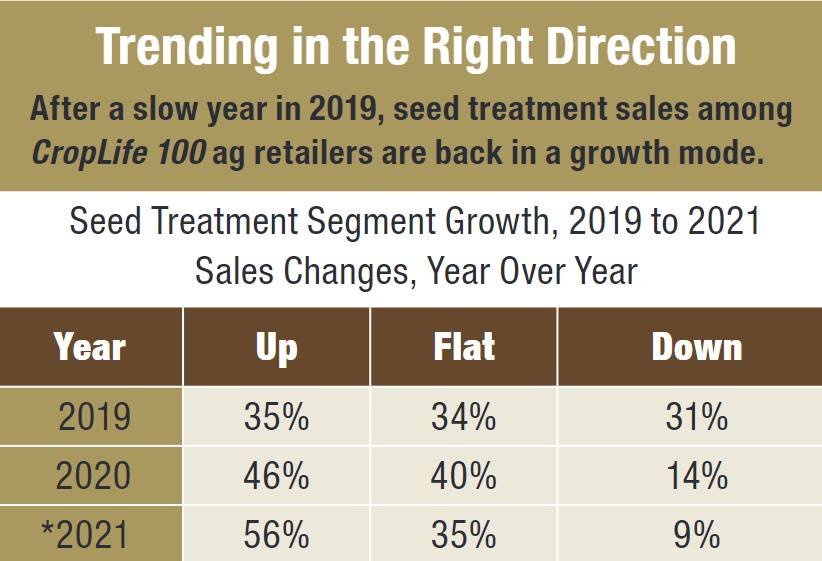

However, in the past few years, the seed treatment segment hasn’t enjoyed quite so much success in terms of overall sales for ag retailers as it once did. In fact, according to the 2019 CropLife 100 survey, only 35% of respondents saw their seed treatment sales increase between 1% and more than 5% for that growing season (with 34% reporting flat sales and 31% seeing sales declines).

Luckily, these percentages improved in the 2020 CropLife 100 survey, with 46% of respondents saying their seed treatment sales improved between 1% and more than 5% for the year.

Furthermore, this good news for the seed treatment segment looks like it will continue for the 2021 growing season. According to preliminary data from this year’s survey, 56% of CropLife 100 retailers will record between 1% and more than 5% sales increases in this area of their businesses. Only 9% are expecting to see a sales decline. The remaining 35% are reporting no sales changes between 2021 and 2020.

The Commodity Price Equation

So, what’s changed to improve seed treatment sales fortunes among the nation’s leading ag retailers this year? According to Pirak, it largely ties back to a question of money for many grower-customers.

“When grain prices are lower, some guys don’t want to spend the extra money on treatment,” she says. “This year, crop prices are good for growers. [This means they are] more apt to spend their dollars on the prevention of insects.”

Jacob “Jake” Larson, Lead for the Seed Treatment Department at Asmus Farm Supply (AFS), Rake, IA, agrees that higher commodity prices in 2021 helped boost seed treatment segment sales for many ag retailers. But, he adds, the crop mix has helped as well.

“This segment has been a growth vehicle, but 2020-21 more so than others,” says Larson. “We had a perfect storm this year, with good soybean prices and soybeans getting planted in April. Growers wanted all the protection they could get.

“Farming practices are lending themselves toward seed treatment,” he continues. “Growers are planting soybeans at the same time as corn into cool and wet soils. Soybeans are no longer a ‘throw-away crop.’ Growers are raising high-yield soybeans and put-ting everything they can into them.”

Future Prospects

According to Valley Ag Supply’s Pirak, the future for the seed treatment segment among ag retailers looks equally promising, providing certain circumstances remain stable between the end of the 2021 growing season and the start of the new one in 2022. “I think with grain prices strong, seed treatments will be a ‘for sure’ for growers for the next year,” she says. “Beyond that, agronomy must guide that decision.”

AFS’ Larson agrees with the “agronomy must guide” part of Pirak’s view. Indeed, he says this is one of the major ways his company keeps seed treatment options before its grower-customers year in and year out.

“For a portion of growers, seed treatment is out-of-site, out-of-mind,” says Larson. “Our goal is to show the value of seed treatment, no matter the planting date or commodity price. We focus on risk management and covering all our bases, not knowing what the season will bring. We package our seed treatments with multiple fungicides, insecticides, inoculants, micronutrients, and plant growth regulators. We do not know what the year will bring, so we hedge our bet by treating with both offensive and defensive components.”

Looking more specifically at the prospects for seed treatment in 2022, Larson thinks the current slate of market forces driving much of what’s going on in the ag retail space will continue for some time to come.

“I believe seed treatment will be a growth area for the coming years,” he says. “The sky is the limit with the biological treatments that are in the pipeline.”

However, there are a few warning signs that shouldn’t be ignored, he adds. “Increased pressure on neonicotinoid insecticides and the difficulty of getting new products registered will be hurdles to overcome,” says Larson.